Housing Rent Own A Comprehensive Guide

Financial Aspects of Renting vs. Owning

Housing rent own – Choosing between renting and owning a home involves a significant financial commitment. Understanding the long-term implications of each option is crucial for making an informed decision. This section compares the financial aspects of renting and owning, considering various factors like mortgage payments, taxes, maintenance, and potential appreciation.

Long-Term Financial Comparison: Rent vs. Own

The following table compares the estimated costs of renting versus owning a home over 10 and 20-year periods. Note that these are illustrative examples and actual costs will vary based on location, property type, and individual circumstances. It’s crucial to conduct personalized financial planning before making a decision.

| Cost Category | Renting (10 years) | Renting (20 years) | Owning (10 years) | Owning (20 years) |

|---|---|---|---|---|

| Housing Payment | $120,000 (example) | $240,000 (example) | $200,000 (mortgage principal & interest) (example) | $400,000 (mortgage principal & interest) (example) |

| Property Taxes (Owning) | – | – | $20,000 (example) | $40,000 (example) |

| Maintenance (Owning) | – | – | $30,000 (example) | $60,000 (example) |

| Insurance (Owning) | – | – | $10,000 (example) | $20,000 (example) |

| Closing Costs (Owning – one-time) | – | – | $10,000 (example) | $10,000 (example) |

| Total Estimated Cost | $120,000 | $240,000 | $270,000 | $530,000 |

Tax Advantages and Disadvantages of Homeownership

Homeownership offers certain tax advantages, primarily through deductions for mortgage interest and property taxes. However, these benefits are subject to limitations and income thresholds. Consult a tax professional for personalized advice.

Mortgage Types and Long-Term Affordability

Various mortgage types exist, each with its own terms, interest rates, and repayment schedules. Fixed-rate mortgages offer predictable payments, while adjustable-rate mortgages (ARMs) carry fluctuating interest rates. Understanding the implications of each type is vital for long-term financial planning. For example, a 30-year fixed-rate mortgage provides lower monthly payments but results in higher total interest paid compared to a 15-year mortgage.

Breakdown of Closing Costs

Closing costs encompass various fees associated with purchasing a home. These include appraisal fees, loan origination fees, title insurance, and recording fees. These costs can significantly add to the overall purchase price, often ranging from 2% to 5% of the loan amount. It’s important to budget for these expenses in advance.

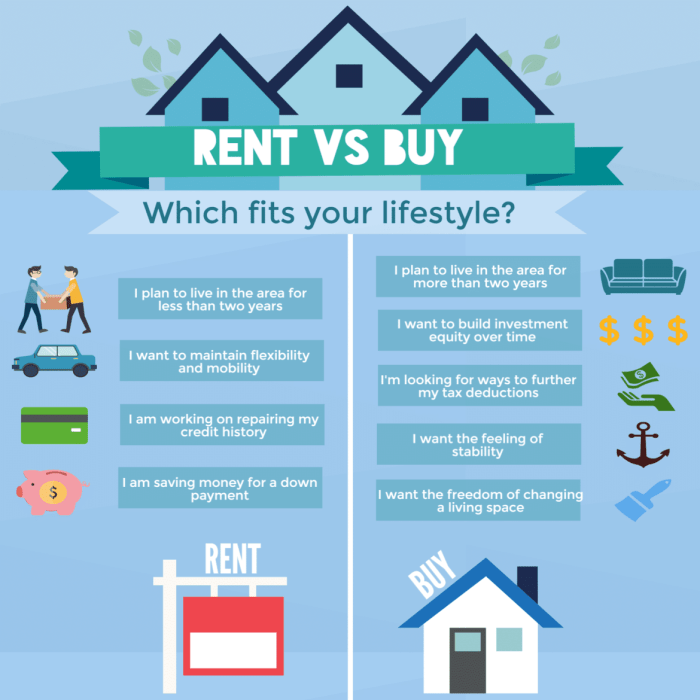

Lifestyle Considerations: Rent vs. Own

Beyond the financial aspects, renting and owning offer distinct lifestyle advantages and disadvantages. This section explores the differences in flexibility, responsibilities, and community involvement associated with each choice.

Lifestyle Comparison: Rent vs. Own

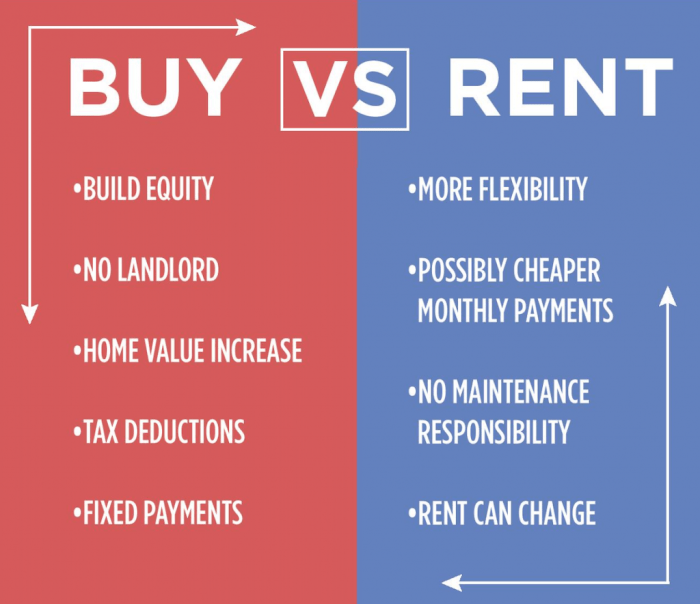

The following chart summarizes the pros and cons of renting and owning a home, focusing on lifestyle factors.

| Factor | Renting: Pros | Renting: Cons | Owning: Pros | Owning: Cons |

|---|---|---|---|---|

| Flexibility |

|

|

|

|

| Responsibilities |

|

|

|

|

| Community |

|

|

|

|

Situations Favoring Renting

Renting is often advantageous in situations requiring flexibility, such as job relocation, temporary assignments, or periods of uncertainty. The ease of moving and reduced commitment makes renting a practical choice under these circumstances.

Benefits of Homeownership

Owning a home offers the benefit of building equity, creating a personalized living space, and fostering a sense of stability and community involvement. The long-term financial benefits of appreciation can also outweigh the costs over time.

The Home-Buying Process: Housing Rent Own

Purchasing a home involves several key steps, from finding a suitable property to finalizing the transaction. Understanding this process is essential for a smooth and successful home buying experience.

Steps in the Home-Buying Process

- Pre-approval for a mortgage: Getting pre-approved helps determine your budget and strengthens your offer.

- Finding a real estate agent: A buyer’s agent can assist with property searches, negotiations, and paperwork.

- Searching for a home: Explore different neighborhoods and properties to find a suitable match.

- Making an offer: Negotiate the purchase price and other terms with the seller.

- Home inspection: A professional inspection identifies potential issues with the property.

- Appraisal: The lender assesses the property’s value to ensure it aligns with the loan amount.

- Loan processing: The lender processes your mortgage application and verifies your financial information.

- Closing: The final step where you sign the paperwork, pay closing costs, and receive the keys to your new home.

Key Professionals Involved

Real estate agents, mortgage lenders, appraisers, inspectors, and title companies play crucial roles in the home-buying process. Each professional contributes specific expertise to ensure a successful transaction.

Key Documents and Paperwork

The home-buying process involves various documents, including the purchase agreement, mortgage application, appraisal report, inspection report, and closing disclosure. Understanding these documents is crucial for a transparent and informed transaction.

Understanding Rental Agreements

Rental agreements Artikel the terms and conditions of a tenancy. Understanding these agreements is crucial for both landlords and tenants to protect their rights and responsibilities.

Types of Rental Agreements, Housing rent own

Different types of rental agreements exist, including month-to-month, lease agreements with fixed terms (e.g., one year, two years), and subleases. Each type has implications for the duration of the tenancy and the terms of termination.

Rights and Responsibilities of Landlords and Tenants

Source: kimwirtz.com

Standard lease agreements detail the rights and responsibilities of both parties. Landlords are responsible for maintaining the property’s habitability, while tenants are responsible for paying rent and respecting the property.

Common Clauses in Rental Agreements

Source: razorbackmoving.com

Rental agreements often include clauses regarding rent payment, lease duration, pet policies, maintenance responsibilities, and termination procedures. Understanding these clauses is essential for both landlords and tenants.

Key Terms and Conditions in Rental Agreements

| Term | Description | Landlord Responsibility | Tenant Responsibility |

|---|---|---|---|

| Rent | Monthly payment for the property | Receive rent payments | Pay rent on time |

| Lease Term | Duration of the rental agreement | Enforce lease terms | Abide by lease terms |

| Security Deposit | Funds held to cover potential damages | Return deposit (less damages) | Maintain property condition |

| Maintenance | Repairs and upkeep of the property | Handle major repairs | Report issues promptly |

Market Trends and Factors Influencing Decisions

Housing market trends, interest rates, and personal circumstances significantly influence the decision to rent or buy. Understanding these factors is crucial for making an informed choice.

Current Market Trends

Source: sgmoneymatters.com

The decision between renting and owning a home is a significant one, impacting your finances and lifestyle. When considering your options, exploring available rentals can be a helpful first step. For instance, if you’re looking in the Victorville area, you might find suitable properties via this link: houses for rent victorville. Ultimately, understanding the local market informs whether renting or buying aligns better with your current housing goals.

Housing costs vary significantly across regions. Factors such as population growth, economic conditions, and available inventory influence prices. Some regions experience rapid price increases, while others may see slower growth or even declines. For example, coastal areas often command higher prices due to limited land availability and high demand.

Impact of Interest Rates

Interest rates directly impact mortgage affordability. Lower interest rates lead to lower monthly payments, making homeownership more accessible. Conversely, higher interest rates increase monthly payments, potentially reducing affordability.

Factors Influencing Rent vs. Buy Decisions

Personal financial situations, job security, and lifestyle preferences are crucial factors in deciding between renting and owning. Individuals with stable finances and long-term plans might prefer homeownership, while those with less financial stability or a desire for flexibility may opt for renting. For example, a young professional starting their career might prefer renting for greater flexibility, while a family planning to stay in one location long-term might choose to buy.

Supply and Demand in the Housing Market

The relationship between supply and demand significantly impacts both rental and purchase prices. A shortage of available housing leads to increased prices, while an oversupply can depress prices. A simple graph illustrating this would show price on the vertical axis and quantity (supply and demand) on the horizontal axis. The intersection of the supply and demand curves determines the equilibrium price.

A shift in either curve (e.g., increased demand due to population growth) will cause a corresponding shift in the equilibrium price.

Top FAQs

What are the typical lease terms for rental agreements?

Lease terms commonly range from six months to a year, but longer-term leases are also available.

How much should I save for a down payment on a house?

The typical down payment is 20% of the home’s purchase price, though some lenders offer options with smaller down payments.

What is an escrow account, and why is it used?

An escrow account is a trust account used to hold funds for property taxes and homeowners insurance, ensuring these payments are made on time.

What are some common reasons for a rental application to be denied?

Common reasons include poor credit history, insufficient income, or a history of evictions.

What are property taxes and how are they calculated?

Property taxes are annual taxes levied on the assessed value of a property. Calculation methods vary by location.